HECM For Purchase

Buy a Home Without Monthly Mortgage Payments

If you are 62 years or older, the Home Equity Conversion Mortgage (HECM) for Purchase Loan can help you buy your next home without required monthly mortgage payments.1 The HECM for Purchase is a Federal Housing Administration (FHA) insured2 home loan that allows seniors to use the equity from the sale of a previous residence to buy their next primary home in one transaction.

Regardless of how long you live in the home or what happens to your home’s value, you only make one, initial investment (down payment) towards the purchase.

Customer benefits include:

- Eliminates monthly mortgage payments1

- Increases your purchase power

- Preserves your cash

Why Consider A HECM For Purchase Loan

Many home buyers use the HECM for Purchase Loan to:

- Right-size to a smaller, lower maintenance home

- Buy a home closer to family or friends

- Lower their cost of living during retirement

- Enjoy carefree living in a senior housing community

Since monthly mortgage payments are not required, a HECM for Purchase Loan may help preserve your hard-earned savings and improve cash flow. You will continue to own and maintain the title of your home for as long as the property remains your primary residence and you continue to meet the obligations of the loan.1

Eligibility Requirements

- Youngest titleholder must be 62 years or older

- Purchased home must be a primary residence occupied within 60 days of loan closing

- Property must be a single family home, 2-to-4 unit owner-occupied dwelling, FHA approved condo, or manufactured home that meets FHA requirements.

- The difference between the purchase price of the new home and the HECM loan proceeds must be paid in cash from qualifying sources such as the sale of prior residence, home buyer’s other assets or savings

- Borrower must complete a HUD approved counseling session

- Must meet financial eligibility criteria as established by HUD

Determining Your Proceeds

The amount of money you may receive from a HECM for Purchase Loan depends on the age of the youngest titleholder, current interest rates and the lesser of the appraised value, the purchase price or the FHA lending limit. The funds available to you may be restricted for the first 12 months after loan closing, due to HECM requirements. In addition, you may need to set aside additional funds from loan proceeds to pay for taxes and insurance. Consult a Liberty Advisor for detailed program terms.

Safeguards for Borrowers

- Mortgage Insurance Premium (MIP)2 ensures the amount owed on the loan can never be more than the value of the home at time of sale

- Independent HUD counseling is required prior to loan application

- Lender may only look to the value of the home for repayment; no other assets may be attached if the loan balance grows beyond the mortgaged home value (non-recourse loan)

Example of How A HECM For Purchase Works

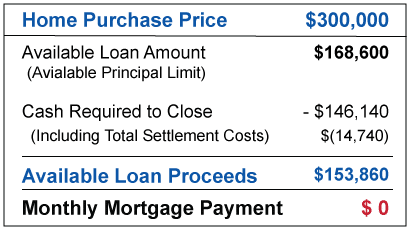

Don who is 68 years old, wants to move closer to family. The value of his current home is $400,000. The purchase price of his next home is also $300,000. However, he wants to eliminate his monthly mortgage payments.

Don may use the proceeds from a HECM for Purchase Loan of $168,6003 and a cash investment of $146,140 to purchase his next home, eliminate monthly mortgage payments1 and move closer to family.

Go to top of page and determine your eligibility for a reverse mortgage loan

1 You must live in the home as your primary residence, continue to pay required property taxes, homeowners insurance, and maintain the home according to FHA requirements. Failure to meet these requirements can trigger a loan default that may result in foreclosure.

2 As required by the Federal Housing Administration (FHA), you will be charged an initial mortgage insurance premium (MIP) at closing and, over the life of the loan, you will be charged an annual MIP based on the loan balance.

Disclosure Information Referencing the Example Above

3 This example is based on the youngest borrower, who is 68 years old, a variable rate HECM for Purchase loan with an initial interest rate of 2.495% (which consists of an ARM index rate of 0.12% and a margin of 2.375%.) It is based on a purchase price of $300,000, origination charges of $5,000, a mortgage insurance premium of $6,000, other settlement costs of $3,740; amortized over 384 months, with total finance charges of $153,860 and an annual percentage rate of 4.53%. Interest rates may vary and the stated rate may change or not be available at the time of loan commitment.